Dollars vs Pesos: The Savvy Traveler’s Guide to Currency in Los Cabos

Picture this: You’re sitting at a beachfront restaurant in Cabo, watching the sunset paint the sky in impossible shades of orange and pink, when the bill arrives. The server asks that familiar question: “Dollars or pesos?” Your answer could mean the difference between paying fair market price and falling into what I call the “gringo tax” trap.

Welcome to beautiful Los Cabos! As you plan your dream getaway, one of the most common questions we get is about money: “Should I use US dollars or Mexican pesos?” While many places in this tourist-friendly paradise accept dollars, relying solely on them can lead you into a common “tourist money trap,” costing you more than you think.

Here’s the thing – I’ve watched countless travelers unknowingly hand over extra cash simply because they didn’t understand the currency game. This guide will walk you through the ins and outs of currency in Cabo, helping you understand the difference between tourist rates and official exchange rates, the best ways to pay, and how to get the most value for your money.

Making smart choices about using dollars vs. pesos in Los Cabos will leave you with more to spend on what truly matters: creating unforgettable vacation memories. Trust me, your wallet will thank you.

The Exchange Rate Game: Tourist Rate vs. Bank Rate

Let’s start with some truth telling: understanding exchange rates is the first step to saving money in Mexico. Don’t let convenience cost you – because it absolutely will.

What is the “Tourist Exchange Rate”?

Think of the tourist exchange rate as the “convenience tax” you didn’t know you were paying. This is an arbitrary, less favorable rate set by individual businesses – restaurants, shops, tour operators – purely for their convenience and profit.

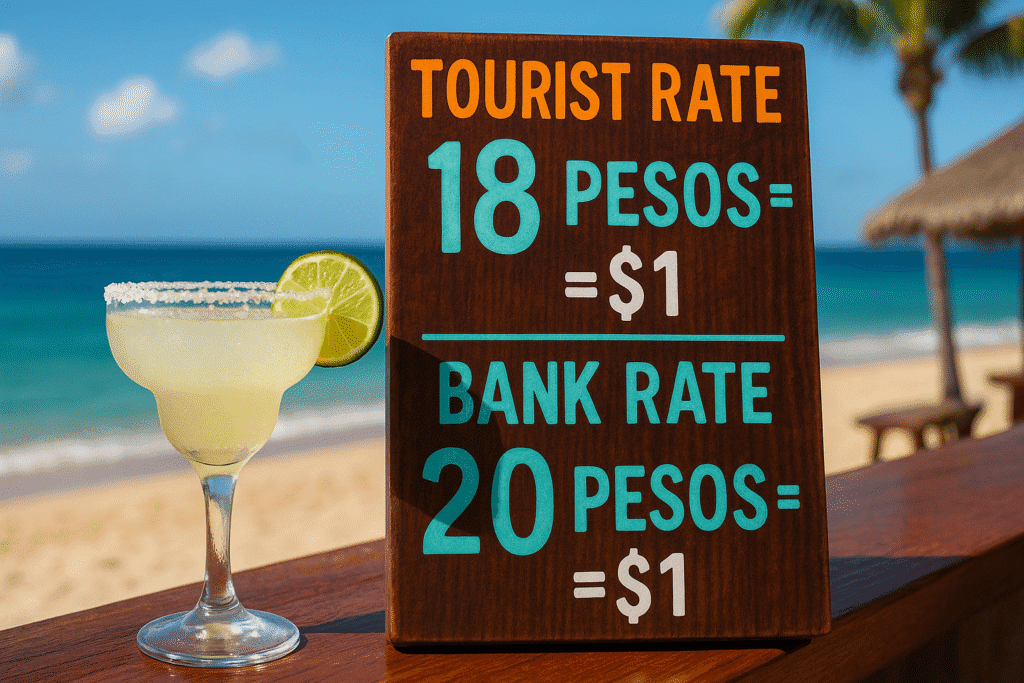

Here’s how they get you: while the official bank rate might be hovering around 20 pesos to 1 USD, that beachfront cantina will casually round it down to something like 18:1. Seems close enough, right? Wrong. That seemingly small difference is always calculated in the business’s favor, and it adds up faster than you can say “another round of margaritas.”

Let me paint you a picture with real numbers. Say you’re treating yourself to a spectacular dinner that costs 2,000 pesos. At a current bank rate of 20:1, you should pay $100 USD. But if that restaurant is using their “convenient” tourist rate of 18:1, they’ll charge you roughly $111 USD for the same meal. You’ve just paid an extra $11 for the privilege of using dollars – that’s an 11% markup disguised as convenience.

Pro tip: Anytime someone offers you a “convenient” exchange rate, alarm bells should go off. Convenience rarely comes free in the currency world.

Why Paying in Pesos is Almost Always Better

Here’s where I’m going to save you some serious cash: when you pay in pesos, you’re using the current, official bank exchange rate, which is almost always more favorable than any tourist rate you’ll encounter.

This ensures you’re paying the true price of goods and services – no hidden markups, no “convenience fees,” just honest-to-goodness fair market value. It’s like getting the VIP treatment without the VIP price tag.

The best way to get pesos? Through a bank ATM or by using a credit card that offers competitive exchange rates. These methods tap directly into the interbank exchange rate, which is as close to the “real” rate as us mere mortals can get.

Your Plastic Companion: Using Credit Cards Wisely

Credit cards are your secret weapon in the currency wars – they offer security, convenience, and excellent exchange rates. But only if you play by the rules. Get this wrong, and you’ll be bleeding money faster than a tourist at a timeshare presentation.

The Best Credit Cards for International Travel

First things first: you absolutely need a credit card with no foreign transaction fees. This isn’t negotiable – it’s the difference between smart travel and expensive lessons. Cards that charge 2-3% foreign transaction fees will eat into your vacation budget like termites in a wooden house.

Visa and Mastercard are your best friends in Cabo – they’re accepted virtually everywhere, from high-end resorts to humble taco stands. American Express? Not so much. While some upscale establishments accept it, you’ll find yourself out of luck more often than not.

Here’s a move that’ll save you headaches: call your bank before you travel. I know, I know – nobody likes calling their bank. But trust me on this one. Let them know your travel dates and destinations. Nothing ruins a perfect vacation dinner like having your card declined because your bank thinks someone stole it and decided to go on a Cabo spending spree.

The Golden Rule: “Always Choose to Pay in Pesos”

This is where I’m going to save you the most money, so pay attention. When that credit card terminal asks if you want to pay in USD or MXN (pesos), always, always choose MXN.

This choice involves something called Dynamic Currency Conversion (DCC), and it’s designed to separate tourists from their money. Here’s how it works: if you choose USD, the local merchant’s bank does the currency conversion using their unfavorable rate. If you choose MXN, your own bank back home handles the conversion at a much better rate.

This single choice – literally pressing one button instead of another – can save you 5-10% on every single transaction. Over the course of a week-long vacation, that’s easily a couple hundred dollars staying in your pocket instead of lining someone else’s.

I’ve seen people lose $50-100 per day just from making the wrong choice at checkout. Don’t be that person.

Cash is Still King: ATMs and Small Purchases

Despite living in an increasingly digital world, you’ll definitely need cash for some of the best parts of Cabo. The most authentic experiences – the hole-in-the-wall taco joints, the local markets, the spontaneous beach vendor encounters – often operate in the cash economy.

Bank ATMs vs. Street ATMs: A Guide to Safety and Fees

Not all ATMs are created equal, and in Cabo, this distinction could cost you both money and security. Bank ATMs are your gold standard – they’re secure, well-maintained, and offer the best exchange rates available to consumers.

Look for ATMs attached to or inside reputable banks like Banorte, Santander, Scotiabank, or CI Banco. These machines are regularly serviced, monitored, and offer direct access to the interbank exchange rate.

Now, let me warn you about the wolves in sheep’s clothing: standalone “street ATMs” you’ll find scattered around hotel lobbies, corner stores, and sidewalks. These things are money vampires. They charge exorbitant fees (sometimes $5-10 USD per transaction), offer poor exchange rates, and carry higher security risks including card skimmers.

Here’s a money-saving strategy: take out larger sums at once – think $300-500 USD equivalent – to minimize the per-transaction fees your home bank charges for international withdrawals. Yes, carrying more cash requires more caution, but the math works heavily in your favor.

When to Use Cash: Tacos, Taxis, and Tips

Cash opens doors to authentic experiences that credit cards simply can’t. Many of the smaller, local experiences that make Cabo special operate exclusively in cash.

Taxis & Transportation: Most local taxis are cash-only operations, and pesos will get you better treatment and prices. While Uber operates on a card-based system, your driver will appreciate a cash tip – it goes directly into their pocket without platform fees.

Street Food & Local Eateries: The most incredible tacos, the freshest ceviche, the most authentic Mexican breakfast – you’ll find these treasures at small stands and local joints that almost always deal exclusively in cash. This is where your pesos really shine, and where you’ll create the most memorable food experiences.

Tipping: While you can add gratuity to restaurant bills via credit card, cash tips (whether pesos or dollars) ensure the money goes directly to your server, housekeeper, or tour guide. It’s more personal, more immediate, and universally appreciated.

Cash vs. Card Quick Reference

Use Credit Card (Pay in Pesos)

- Large Restaurant Bills

- Supermarket Purchases (La Comer, Chedraui)

- High-End Shopping & Boutiques

- Activities & Tours (booked at established offices)

- Car Rentals

Use Cash (Pesos Preferred)

- Tipping (for anyone)

- Taxis & Public Transport

- Street Food & Taco Stands

- Small Souvenirs & Market Purchases

- Roadside Coconut Stands

Frequently Asked Questions

Absolutely – but not for the reasons you might think. Bring a small amount of US dollars ($100-$200) for immediate needs upon arrival: airport tips, that first drink while you get your bearings, or emergency situations before you can access a proper bank ATM. Think of dollars as your "first day survival kit," not your primary currency strategy.

Tipping in Cabo follows similar guidelines to the US, but with some local nuances. For restaurants, 15-20% is standard and appreciated. For daily housekeeping at your villa, $5-10 USD per day (or peso equivalent) shows proper appreciation. Bellhops, drivers, and tour guides typically receive $1-5 USD depending on the level of service – use your judgment and err on the side of generosity.

Yes, you can use your US debit card at bank ATMs to withdraw pesos, and this is actually one of the best ways to get local currency. However, check with your bank about international withdrawal fees – they vary wildly between institutions. For purchases, stick with credit cards due to their superior fraud protection and dispute resolution processes.

Avoid airport exchange kiosks like the plague – they offer terrible rates and prey on tired travelers. If you absolutely must exchange cash, use a bank or a dedicated casa de cambio (exchange house) in town for better rates. But honestly? Using a bank ATM to withdraw pesos directly remains the top recommendation for both convenience and value.

Los Cabos is generally very safe for tourists, but smart money management is always wise. Don't flash large amounts of cash – keep what you need for the day accessible and secure the rest in your villa's safe. Practice basic street smarts: be aware of your surroundings, don't count money publicly, and trust your instincts.

The Bottom Line: Your Money, Your Rules

Navigating the dollars vs. pesos in Los Cabos debate becomes beautifully simple once you understand the rules of the game. By prioritizing peso payments, using a no-foreign-fee credit card, and withdrawing cash from secure bank ATMs, you ensure your vacation budget stretches further and works harder.

This financial savvy allows you to fully immerse yourself in everything Cabo offers – from the finest oceanfront dining to the most delicious street tacos – without paying unnecessary premiums or falling into tourist traps. You’ll eat better, explore more freely, and create richer experiences when you’re not constantly worried about getting ripped off.

The money you save by following these strategies isn’t just numbers on a receipt – it’s an extra sunset dinner, another adventure tour, a nicer bottle of wine, or simply peace of mind that lets you fully embrace your vacation.

Now that your currency questions are answered and your money strategy is locked down, you can focus on the fun part: actually enjoying your Cabo adventure.

Ready to book the perfect home base for your currency-savvy Cabo getaway?

Ready to put your new money knowledge to work? Browse our stunning Casa Heuer villa and start planning your next Mexican getaway with us.